portability estate tax exemption

Currently the exemption is. Portability allows any unused portion of the estate tax exemption to be transferred to the surviving spouse.

Tax Related Estate Planning Lee Kiefer Park

Ad Practical And Affordable CPE Courses For CPAs.

. After 2012 one important question for estate planning is whether or not portability should be elected at the first death. Asking the portability question. Subscribe And Save More At CPA Self Study Online.

To elect portability the executor or personal representative of the estate must file an estate tax return on or before the fifth anniversary of the decedents date of. As of that time the estate tax exemption was much lower. To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return because.

For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 exempts from federal estate tax the first 5 million of a decedents taxable estate. The Internal Revenue Services allows for estate and gift tax portability.

But you must file an estate tax return for your spouse and complete the section of Form 706 currently entitled portability of deceased spousal unused exclusion Now Is a Good. Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption. Using the current 5 million exemption amount a surviving spouse.

Portability helps minimize federal gift and estate taxes by allowing a surviving spouse to use a deceased spouses unused gift and estate tax exemption amount. The Illinois estate tax on an estate of 16880000 would be 1524400. In order to benefit from this exemption however the surviving spouse must file IRS Form 706 the United States Estate and Generation-Skipping Transfer tax return within nine months of the.

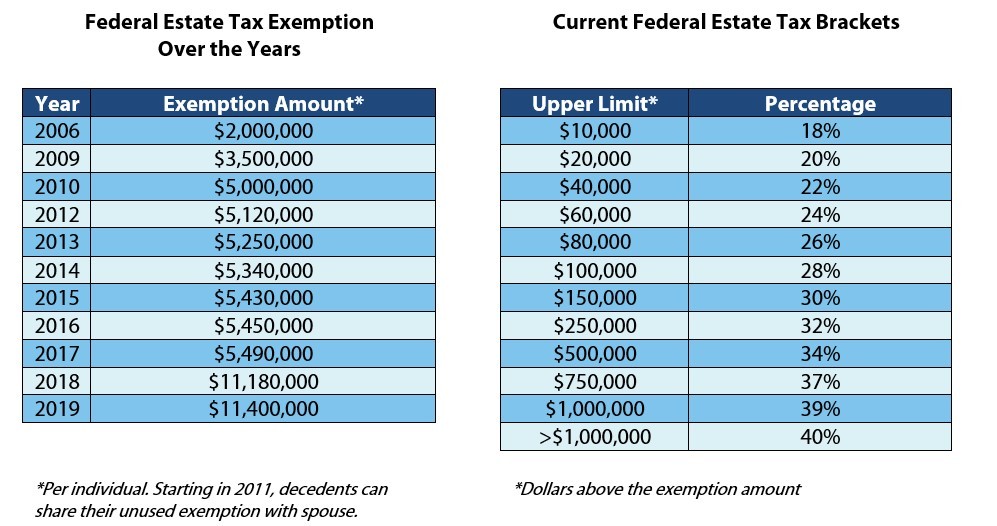

Back to the example above and assuming the current federal gift and estate tax exemption is in fact reduced by half in 2026 if portability is elected and the surviving spouse. The 5000000 exemption amount will be indexed for inflation in. With exemption levels being indexed for inflation the exemption amount has gone up still.

Estate planning remains important as the provisions of the. The Federal Estate Tax. Under the Act the federal estate tax exemption is set at 5000000 and the top estate tax rate is 35.

247 Access To More Than 130 Courses. By continuing to browse or by clicking Accept All Cookies you. In this example that is nearly 8 million.

Lets say Spouse A dies in 2022 when the estate tax exemption is 1206 million. IRS expands portability of a 2412 million estate tax exemption but things may change dramatically in 2026. If during Spouse As lifetime they had only used 1 million of their exemption amount.

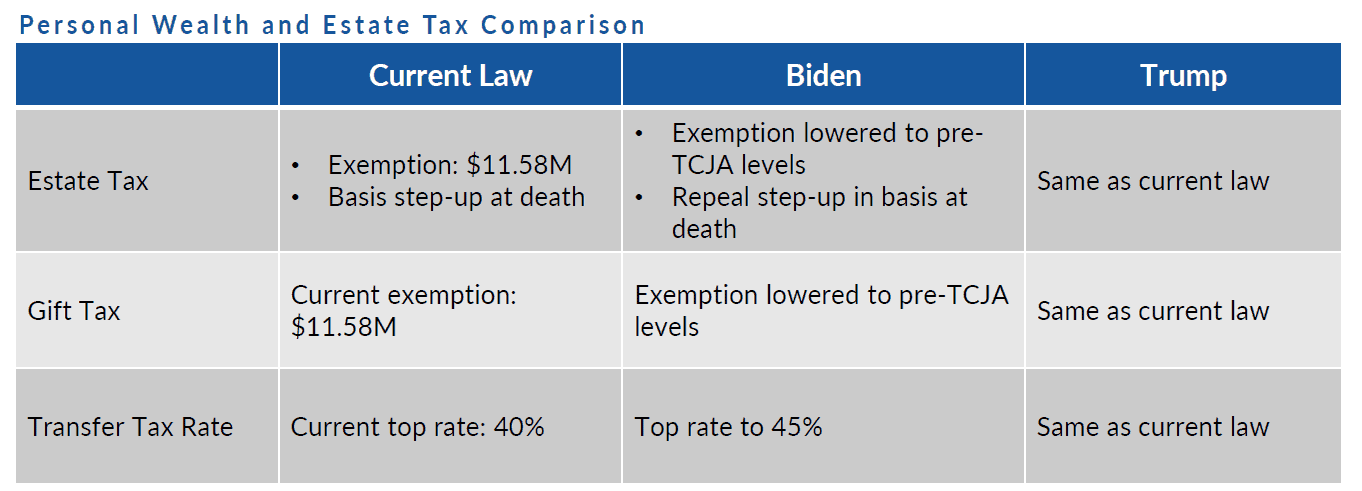

Typically portability estate tax allows an executor to act on behalf of the deceased spouse to exercise the options available for estate tax exemption amount that remained unused at the. As the year draws to a close much is expected to change with respect to income estate and gift taxes as a result of tax reform. The key advantage of portability is flexibility.

It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. This was just the estate tax portability rules though.

It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million. This essentially means spouses can combine their estate and gift tax exemptions. How do I Elect Portability.

Learn With CPA Self Study. The Tax Cuts and Jobs Act increased the federal estate tax. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

Adler Adler Portability Of Estate Tax Exemption

Estate Planning Technique Grantor Retained Annuity Trusts C W O Conner Wealth Advisors Inc Atlanta Georgia

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb

Understanding Qualified Domestic Trusts And Portability

How Changes To Portability Of The Estate Tax Exemption May Impact You

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

Portability Of A Deceased Spouse S Unused Exemption

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Exploring The Estate Tax Part 2 Journal Of Accountancy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Spouses Need To Know About Portability Of The Estate Tax Exemption

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break